Venture capital

Venture capital investors are long-term investors in promising start-ups and small unlisted companies (often called start-ups and scale-ups). Start-ups or scale-ups usually turn to venture capital investors when they need capital to develop a technology, launch their first product, market their product more widely or accelerate growth to achieve market leadership. Banks generally do not provide loans to businesses without turnover or collateral. In this case, venture capital is the way to go. Medium-sized and large companies also often need risk capital for, for example, further growth. This is called private equity.

Start-ups and scale-ups that turn to venture capital investors usually operate in innovative sectors such as 'deep tech' (semicon, nanotechnology, etc.), sustainability, IT and life sciences. The provision of venture capital is the riskiest form of financing of the private equity and venture capital industry. After all, it is still difficult to predict how successful an idea or start-up will be. The increased risk often therefore means venture capital firms are very closely involved in their investments. The investors also usually have a large network of experts, experience in starting a risky business or extensive knowledge of a particular sector. Indeed, the input provided by venture capitalists can be decisive in determining the success of a business.

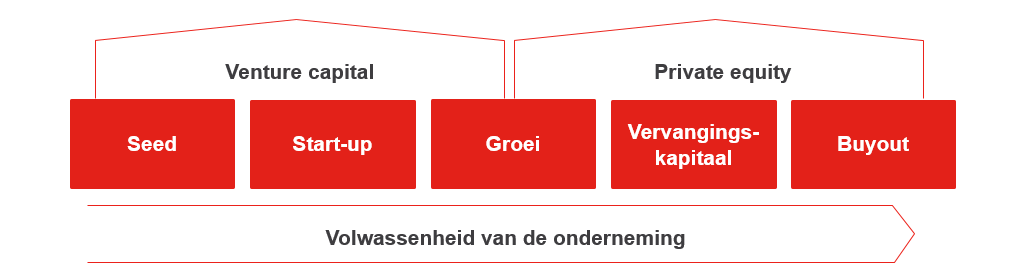

Unlike private equity investors, venture capital investors often take a minority stake. The money invested is mainly used for the development and sale of (new) innovative products. With venture capital, investments may be made in several phases and financing rounds. Broadly speaking, this is as follows (from the very first phase to the IPO/sale).

Besides venture capital investors, Regional Development Agencies (RDAs) are also active in providing risk capital to starters. RDAs were established on the initiative of the Ministry of Economic Affairs and Climate for the purpose of further developing Dutch regions economically. RDAs cover all Dutch provinces. They not only aim to achieve sufficient returns, but also aim to bolster employment and establish innovative companies in a particular region.

In addition, the government promotes the growth of the venture capital sector through numerous loan and grant programmes aimed at fund managers who want to set up a venture capital fund and at companies seeking start-up and growth capital. More information can be obtained from Rijksdienst voor Ondernemend Nederland (RvO) (Netherlands Enterprise Agency).